导读:

数据显示:2017年,只有五家工业公司分配股票股利,占美国上市公司的不到0.2%;20世纪50年代到21世纪初短短 60年间,公司支付股息的比例却减少了75倍之多。为什么股票红利消失了?股票红利是否等同于先进股息?二者在大众认知范畴内是否是同一个概念?在公司支付股息的比例大大下降的同时,为何专业性投资机构在这些年间却拥有越来越多的公司股票?欢迎光临“Vanishing Stock Dividends”主题讲座!

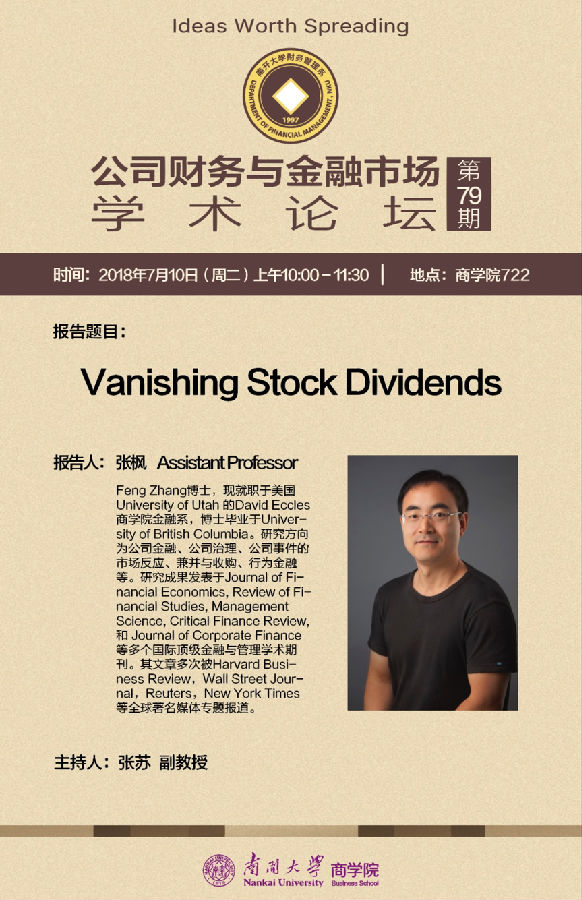

时间:2018年7月10日(星期二)上午10:00

地点:南开大学商学院721

报告题目:Vanishing Stock Dividends

报告人:张枫 Assistant Professor

Feng Zhang博士,现就职于美国University of Utah 的David Eccles商学院金融系,博士毕业于University of British Columbia。研究方向为公司金融、公司治理、公司事件的市场反应、兼并与收购、行为金融等。研究成果发表于Journal of Financial Economics, Review of Financial Studies, Management Science, Critical Finance Review, 和 Journal of Corporate Finance等多个国际顶级金融与管理学术期刊。其文章多次被Harvard Business Review,Wall Street Journal,Reuters,New York Times等全球著名媒体专题报道。

主持人:张苏 副教授

主办方:财务管理系

论文摘要:

We document that stock dividends are vanishing: the probability that a firm distributes stock dividends to shareholders decreases by the factor of 75 over the six decades from the 1950s to the 2010s. In 2017, only five industrial firms distribute stock dividends, representing less than 0.2% of the industrial firms listed in the United States. Why are stock dividends vanishing? We find that the vanishing of stock dividends is not attributable to changing firm characteristics over the six decades. Our review of the history of stock dividends indicates that people including shareholders and the judicial, tax, and accounting authorities—commonly misunderstand the economic substance of stock dividends and mistakenly equate them to cash dividends in the early American commercial history. The investors gradually learn and correct the misunderstanding; during the process, their demand for stock dividends dwindles. In addition, institutional investors, who are more professional than retail investors and are less likely to misunderstand the economic substance of stock dividends, own more and more corporate equities in recent years and thus help correct the misunderstanding. Consistent with the misunderstanding-learning hypothesis, both the Granger causality tests and the instrumental variable regressions suggest that institutional investors have causal and negative effects on the firm’s propensity to distribute stock dividends.